Revenue Generated Doesn’t Matter Without the Personal Wealth or Legacy to Show For It | E1

April 3, 2024

Hitting 6- or 7-figure revenue goals means nothing if you don’t have the personal wealth and legacy to show for it.

There’s way too much emphasis on revenue in the online business world and it leaves us chasing ever next revenue milestone, burning out to try to make more money, when really what you need is for your revenue to meet your lifestyle and legacy goals first.

By the end of this episode, you’ll be able to see how to think about your revenue goal so it actually gives you the lifestyle and legacy you want for you and your family rather than picking an arbitrary milestone that sounds sexy.

This is what’s going to allow you to get clear on what you’re truly needing and how you might even be able to have that right now if you focused on a few other numbers instead of just revenue.

Subscribe on YouTube | Apple | Spotify

Tune in for:

03:02 — The 2 things to consider when creating your revenue goals

06:36 — How to create your legacy plan so you can align revenue goals with what you truly want

10:24 — The 3 numbers you need to know to achieve your personal lifestyle and legacy goals

21:36 — Why you’re living pay-check to pay-check as a multi-6 or 7-figure business owner and how to pay yourself consistently

Impact Over Income

The financial and energetic impact of your business on your life is paramount. Once you pay yourself, are you overcommitting, over-investing, and depleting your profit? Do you experience a lifestyle creep, where your increasing business revenue must support your growing needs? This constant pressure wreaks havoc on your nervous system.

Read also: Why you know how to make money but can’t keep it.

Prioritizing Lifestyle and Legacy Goals

In this first episode of the Harmonious Wealth Podcast, we explore how your business can support your lifestyle and legacy goals instead of chasing arbitrary revenue targets. As a Fractional CFO and bookkeeper, I’m here to guide you through building your financial legacy. Let’s shift our focus from revenue milestones to creating personal wealth and legacy.

The Myth of Revenue Goals

Online business and social media often showcase entrepreneurs celebrating their six-figure months or beyond. However, reaching these milestones involves significant behind-the-scenes work. When setting business goals, start with the end in mind. This involves two key aspects: serving your clients and understanding how your business can serve you.

>

“Each of you should use whatever gift you have received to serve others.”

Creating a Personal Wealth Plan

I’m a firm believer that after we serve God’s children and humanity through our businesses, our businesses must serve us.

Serving us is through being able to pay yourself well from your business.

Your business should be a vehicle for creating personal wealth.

One of my favorite finance books is Robert Kiyosaki’s Cashflow Quadrant. He talks about the different ways people earn money.

First from being an employee to a solopreneur, then a business owner with a team, and finally an investor. Your business should help you progress through these stages, using excess cash to invest in your future.

When you’re able to grow a business that’s a well-oiled machine that’ll allow your operations and team to work on your behalf, you’ve officially hit the 3rd phase of cash flow – business owner.

Once you’ve mastered your profit and successfully managed your cash flow, you’ll be able to use the excess cash to invest.

Our Four-Step Harmonious Wealth Framework

-

Set Legacy Goals: Identify what you love about your life and business, your immediate lifestyle goals, and your long-term business goals.

-

Assess Trends: Review your revenue, profit, and what you pay yourself to uncover gaps.

-

Uncover Immediate Gaps: Highlight where you want to be versus where you are now, focusing on cash flow.

-

Create a Legacy Plan: Develop a three-year profit plan to achieve your goals.

Learn More about our Profit Planning Intensive Services

Knowing Your Numbers

To truly understand your business’s impact, you need to know three key numbers: revenue, profit, and what you pay yourself. Many entrepreneurs only know their revenue, leading to profit and tax surprises. Regularly reviewing your income statement, balance sheet, and cash flow statement is crucial.

Read Also: How to Increase Profit Margins as a Coach or Service Provider

Managing Cashflow

I love the cash flow management strategy, Profit First (another favorite finance book) by Michael Michalowicz. I use an iteration of Profit First for both my business and personal finances. However, blindly using Profit First without understanding your baseline cash flow can be overwhelming.

With our Profit Planning Intensive clients, we map out weekly cash flow for the next year (yes, all 52 weeks). Drilling down to weekly cash flow will ensure you can confidently manage your money, even with humble beginnings.

Support and Strategic Planning

Within the first four weeks of working with us, we’ll establish or improve your financial systems. We help you understand your revenue, expenses, and profit so you can make informed decisions. Our cash flow forecast and personal spending plan ensure you’re no longer guessing what to pay yourself.

Living Beyond Paycheck to Paycheck

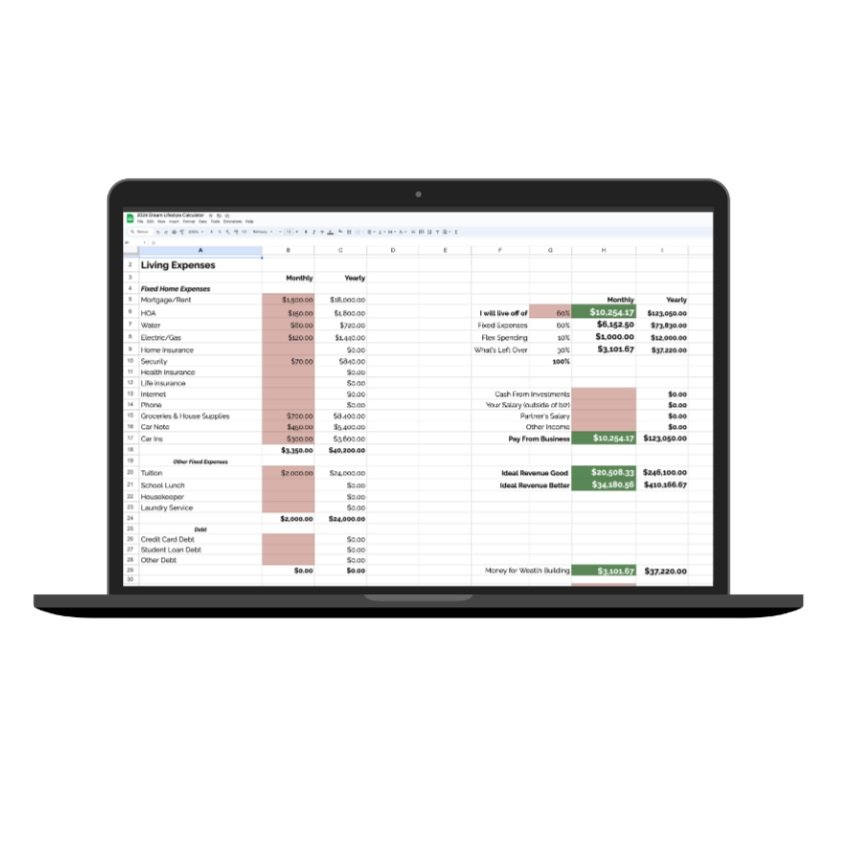

Our goal is to help you thrive, not just survive. Living on 50% of your take-home pay allows you to invest, save, and enjoy life. Use our dream lifestyle calculator to uncover what you need to pay yourself without living paycheck to paycheck.

Visit lovelyfinancials.com/lifestyle to get started.

Quantify Your Dream Life

Uncover what you must pay yourself in your business to accomplish your immediate lifestyle and legacy goals, sign up to get my free The Dream Life Calculator.

Join the Harmonious Wealth Community

If you’re a woman growing your business and family and want to build personal wealth and legacy, subscribe to the Harmonious Wealth Podcast. I aim to help 100 women achieve $1M in net worth to create generational wealth and break generational curses.

Join me on this journey to financial freedom and legacy building.

Top Episodes to Check Out

Revitalizing Your Daily Routine: Easy Ways to Infuse Energy and Positivity

Nurturing Self-Care: Prioritizing Your Well-being in a Busy World

Embracing Simplicity: The Art of Minimalistic Living

Weekly wisdom for faith-filled finances.

Get bite-sized tips on increasing profit, leveraging tax strategy, and stewarding your cash flow—rooted in biblical truth. Build wealth, heal your money story, and lead your business from a place of overflow.

The Overflow Report

THE EMAIL LIST

WEBSITE DESIGN CREDIT

Terms and Conditions

Privacy Policy

Join my email series

Hompage

About

portal

Podcast

Work with us

Browse Around

LFG

Iyanna Vaughn, founder of Lovely Financials Group, believes that financial management significantly impacts one's life. For over 8 years, she has helped business owners increase their profit & create healthy cash flow.

Paragraph

Paragraph