4 Ways to Drastically Improve the Way You Invoice

Newbie entrepreneurs seem to have it rough. You’re in the beginning of a new chapter in your life. You’ve birthed a beautiful baby business. It keeps you up at night. You think about it constantly and you always want to show people how cute it is.

You begin to realize that your baby costs so much but at times, you have trouble speaking up for it. Demanding that your business be is taken more seriously. Creating a routine to make it easier to earn money and help it grow.

You’ve become sort of like the lenient parent who seems to let everything roll. Noticing that in the process, you've been getting taken advantage of. Especially when it comes to earning money in your business.

One of the biggest things I’ve seen is the problems of invoicing clients. They can seem to just not do it all together. Or get nervous when sending them. I’m here to share with you the 4 best ways to handle your invoices that will increase your earning potential.

Ideas to make your process speak for you. These processes talk about the way you invoice. They include recurring invoices, autopay, payment plans with additional fees, and late fees. I hope this post creates a way to help you avoid shrinking in fear when it comes to sending your next client an invoice.

1. Recurring Invoices

Recurring invoices are one of the best ways to make sure you’re not forgetting about sending them to your monthly clients. You can do this in your accounting software or CRM. If you’ve read my previous blog about how to create a great customer experience, you know how much I love 17Hats.

** Update: I've changed my CRM to Dubsado! I'm in love with the software and they now have a feature to do repeating invoices, and recurring subscriptions if you use Stripe!

Read also: 7 Ways to Improve Your Client Experience

17Hats allows you to create these recurring invoices every month or different durations like weekly or biweekly.

Creating invoices that recur such as this helps you avoid looking at your bookkeeping and wondering why you’re missing a few transactions. Or worse - not making a profit!

In your accounting system like Xero (which I use for all of my monthly clients), you can create recurring invoices as well.

Creating these recurring invoices if you’re on retainer avoids your clients from fishing out your PayPal link. It’s just too many steps! Payment is coming right to you at one click from the invoice already created for you!

2. Autopay

This is by far my favorite feature I found for invoicing. I’m sure you can tell why. I use this for my bookkeeping clients from ReRunapp. It helps me avoid waiting for invoice payments from busy bosses. Since I talk to my monthly clients throughout the month, we can avoid the awkward conversation of a late invoice and the “I’ll pay your invoice when we get off this call!”

** Update: I no longer use the ReRunapp. Instead I use stripe to create recurring subcriptions. You can also do this with PayPal!

When I on-board my monthly clients, I create a “live invoice” for the first month. To complete the on-boarding process, they sign up for the autopay portal and I assign their monthly fee there. There are no surprises when this is brought up because I tell them this during our consultation, in the proposal, contract, and finally list of steps in the onboarding process.

On the Rerunapp, I’m able to give emails that include telling clients that their cards are expiring without it coming from my email address.

Having an autopay system definitely, decreases the anxiety of confrontation. And if the client or I feel like we no longer should continue our working relationship, with a click of a button, I can take them off of my autopay system.

If this happens to you, be sure to have a set date on when someone needs to stop the relationship so that you won’t have to backtrack and end up giving them back a large refund!

3. Payment Plans - With or Without Additional Fees

In the creative industry, we’re aware of down payments and other types of payment plans. But why are we sometimes reluctant to do it for our business?

Why are you allowing your deposits to be refundable as a photographer? When someone cancels on you last minute, the opportunity cost is greater because you could have been doing a photoshoot with someone else!

Or let’s get into how we can create a win/win situation.

By creating a payment plan with additional charges. After some research, I saw that people who do plans with additional fees, do so at about 20% of the rate.

This causes increased cash flows in your business AND helps the customer who doesn’t have the funds for your high-end program all at once. We all know that breaking something from $1000 or more to increments of $199 is much more affordable.

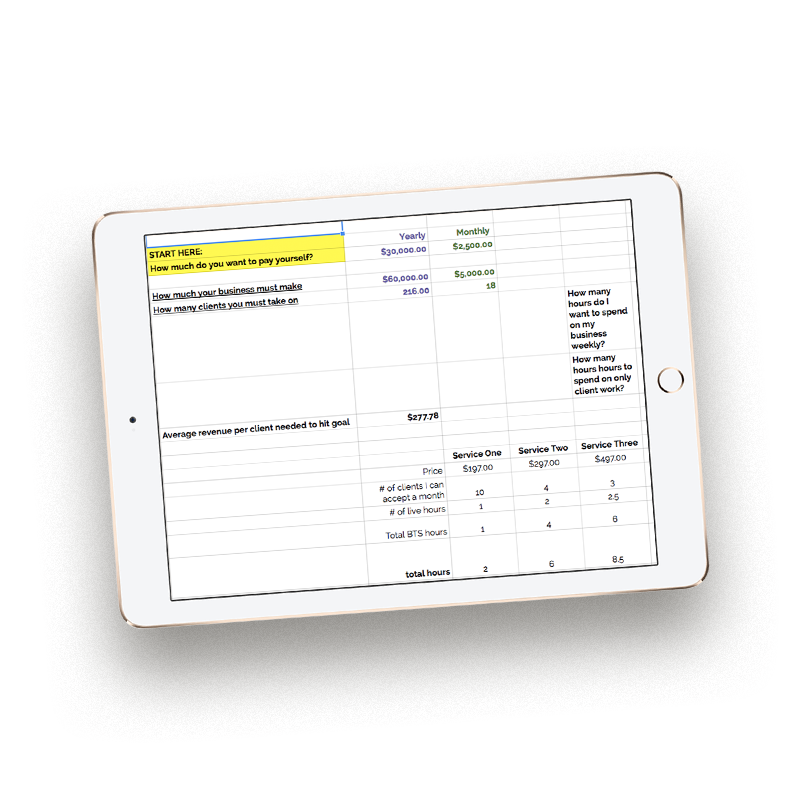

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!

4. Late fees

Late fees are hidden fruit for business owners. I currently have this in the contract of a 10% fee for late invoices but haven’t had to use since I’m in autopay.

But this speaks volumes for you when you have clients who tend to pay later than we’d like. It increases the discipline in your client as a “go sit in the corner” when they end up paying you 10 days later than your grace period.

You can also take it a step further and have specific days where you’ll take certain action.

For example, when a client doesn’t pay after 21 days, it’s quite possible our relationship will be terminated.

Invoicing is just a part of the process of making business. When I say create a process that speaks for you, it’s for your benefit. It’s also for the benefit of your client. They’ll know the repercussions of when you make an error and they’ll also know not to take advantage of you.

I hate hearing stories about new entrepreneurs getting duped by their idol who treated them wrongfully behind the scenes. I help these clients manage their money better and create a better system to increase their earning potential. I do this by creating the BYOBB (Be Your Own Bookkeeper Blueprint).

We talk about creating a boundary that we can’t go under a certain price because of our revenue goals.

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!