How to Perfectly Price the Services in your Business

December 27, 2016

Please note that this post contains affiliate links. Read my legal page for further reference.

As I write this post, I realize that I’m about one month out from my one year anniversary of creating my LLC. I never thought in a million years, I’d be creating a business. Especially one that is solely online! Through this year I have grown a layer of skin. I began to learn how to not take everything so personal. Stop taking everything so serious when it comes to people being interested in my service.

I started out doing just about everything that I was good at. From being enthusiastic about accounting, admin assistance, and graphic design. I liked all of them but I wasn’t totally in love with them. Then after each failure, I figured that I was spreading myself too thin. I was just simply doing too much.

It was a super tough pill to swallow. But when I made the change in my focus, my entrepreneur flower began to blossom.

I initially chose my business name is the Lovelypreneur, LLC. I wanted it to encompass all of my skills in making entrepreneurship easier for the people I served. I yearned to be clever than actually focus.

Sometime in 2017, I will be changing this name to something much more relevant.

One of the most important things that can help you reach your revenue goals is pricing your services. Pricing them the right way!

We like the idea of charging so little in the beginning just to get our feet wet. Even taking on beta clients so that you have the workflow down before you get your first paying client.

I love all of these ideas to gain experience, but it’s now time to start getting paid what your service is worth.

In the previous post, I talked about the 7 things that you can consider when pricing your services. This post will show you the exact steps I took to perfectly price my services. After doing some surveying, I found that I needed more than one option for monthly services. I needed to be able to serve people at different levels in their businesses.

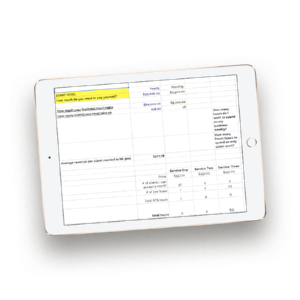

I am positive that this free calculator will help you too.

I created a free calculator and I want to demonstrate exactly how to get the perfect price for your services. Every. Time. Pricing correctly gives you the ability to make sure you’re making enough money. You need to be able to fund your business AND pay yourself. Replace that 9-5 income, girl!

STEP ONE: Know your personal income

What is the absolute amount you need to live off of when it’s time for you to replace your 9-5 income?!

If you know anything about Dave Ramsey, you know he wants us all to avoid being house poor. A great place I like to start is taking your rent/mortgage and multiplying it by 4.

Figuring out what you would like to pay yourself is the place where I like to start with clients. They range from not paying themselves at all. Or taking most of their revenues because they have to.

This will give us a way to structure pricing to fit your needs to create a plan for the future of your business.

If you read the book, Profit First, then you know that in order to remain profitable, your business must pay yourself no more than 50% of revenues.

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!

STEP TWO: Double the personal income to create your revenue goal.

Now you have a ballpark on what you must make to reach your goal.

Let’s say you want to contribute about $1000 to your household to begin with. This will mean that your business must bring in $2000.

But what if you have subcontractors?

Add in the amount you spend on contractors to the $2000. More about this on the worksheet for Profit First!

STEP THREE: Calculate the average amount of revenue each client must bring in.

So now that you have your revenue goal. The calculator will automatically populate what you must charge each client on average.

*Note the less number of clients have, the more you’d have to charge each client to reach your income goal.*

STEP FOUR: Know how many hours you’d like to spend on client work

This is a hard lesson to understand as you grow your business. So many people talk about being a manager vs being a CEO. Once you become more of a CEO, you will see that you will be spending more hours on your business. This includes working on marketing, speaking engagements, and creating content.

Figure out all of the hours you can spend on your business aside from your 9-5. How many of those do you want to dedicate those to client work?

STEP FIVE: Separate your services from lower end to higher end

According to a great business mentor, Courtney Johnston of The Rulebreaker’s Club, make your services more reachable to your audience. This means that you should have a lower end service AND a premium product/service. You will also build trust in your clients who may invest more in your services the next time around.

The other tier will be you rolling out the red carpet for your client.

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!

STEP SIX: Know how many hours you’re spending on each service type.

Separate the hours spent on the project with live hours vs behind the scenes hours.

After your discovery call, how many hours are you working with your client face-to-face vs drafting emails, designing, etc.?

You can track how many hours you work on your services through apps like Toggl and 17Hats.

Once you have your system streamlined, these behind the scene hours should decreased while improving your client experience.

STEP SEVEN: Calculate how much you’re making an hour

Understand that you must make more than what you would as an employee. No more working for $15/hr when you’re running your own business. You have to make enough to eventually pay yourself, reinvest, pay taxes, and cover expenses. I would double what you would have made as an employee to start out with.

STEP EIGHT: Figure out how many clients you’d need to take on to reach your income goals

This is where it gets fun. Play around with the numbers for the tiers and see how you can make your income goals come true.

First, put in your current pricing structure. See if you’re charging too much or too little for your services, then see if you can afford to make a tier.

STEP NINE: See if the hours spent are realistic

Now that you’ve reached your income goal, have you reached the hours you’d like to spend on your business? Is it too much? This is what happened to me at first. I was charging way too little for my services and spent too many hours.

Now that you have at least two types of services, you can play around with the numbers.

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!

How did you do? Are you pricing your services where they need to be?! I’d love to know how you enjoyed the calculator in the comments. Thank you for reading and watching!

Top Episodes to Check Out

Revitalizing Your Daily Routine: Easy Ways to Infuse Energy and Positivity

Nurturing Self-Care: Prioritizing Your Well-being in a Busy World

Embracing Simplicity: The Art of Minimalistic Living

Weekly wisdom for faith-filled finances.

Get bite-sized tips on increasing profit, leveraging tax strategy, and stewarding your cash flow—rooted in biblical truth. Build wealth, heal your money story, and lead your business from a place of overflow.

The Overflow Report

THE EMAIL LIST

WEBSITE DESIGN CREDIT

Terms and Conditions

Privacy Policy

Join my email series

Hompage

About

portal

Podcast

Work with us

Browse Around

LFG

Iyanna Vaughn, founder of Lovely Financials Group, believes that financial management significantly impacts one's life. For over 8 years, she has helped business owners increase their profit & create healthy cash flow.

Paragraph

Paragraph