Why You Know How to Make Money but Can’t Keep It | E3

April 17, 2024

As a successful online business owner, you might have imagined that once you started making 6-figures, multiple 6-figures, or even 7-figures in your business, you would simply know how to manage your money.

But here you are, with a multi-6 or even 7-figure business and you still feel like you have just enough to get by.

That’s because making more money doesn’t solve the root of what is causing you to mismanage your money.

In this episode, Iyanna is exploring the depths of the real reasons why you don’t know how to manage your money — despite being really good at making it.

By the end of the episode, you’ll see why reaching your next revenue goal won’t solve this problem and you’ll understand the work that needs to be done so you can change your relationship with money, live in surplus, and have the salary to create the lifestyle and legacy you want without exceeding your means.

Subscribe on YouTube | Apple | Spotify

Tune in for:

03:09 — Decenter money and its connection to your worth

06:31 — How the poverty mindset is still sabotaging you even though you have more wealth than ever

07:21 — How subconscious patterns self-sabotage your ability to manage additional income

17:41 — How to become comfortable living in the surplus rather than in the “just enough”

28:14 — Your willpower alone will not help you reach the success that you desire

Why Can’t You Maintain Your Money?

One big mistake we make in managing money is centering it in our lives. Much like how we’ve been programmed to center relationships in our lives, we often center money, equating our bank account balance with our self-worth. This mindset needs to change.

Decentering Money for Better Results

What if we decenter money to improve our relationship with it? Instead of obsessing over money, we should establish healthier boundaries. When you stop living every day as if it’s an emergency, you can create peace and contentment in your financial life.

For me, this journey began by centering my life around God, which allowed me to love myself and others more. Serving others often requires earning more, but it’s an exchange, not an obsession. Healing your relationship with money involves understanding and addressing any unhealed masculine energy, such as controlling and competitive behaviors.

Shifting from Control to Trust

When you shift from controlling your finances to trusting the process, you’ll find contentment. You’ll know where your money is going and how it’s working for you. Decentering money can help you show up better in all aspects of your life, from team meetings to client calls.

Healing Your Relationship with Money

Unhealthy relationships with money often stem from a poverty mindset, where success feels temporary and risks are avoided. Understanding that you don’t need to beg for money, much like you don’t beg for love, can help heal this relationship.

Tactical Steps to Financial Harmony

-

Identify Immediate Lifestyle Goals: These might include family vacations, debt repayment, or buying a home. Assess what you can achieve within the next 12 months.

-

Visualize Your Future: Quantify your dream life, including monthly mortgage payments, retirement savings, and other expenses.

-

Automate Your Finances: This helps reduce control issues and allows money to flow more freely into your life.

The Cashflow Quadrant

Robert Kiyosaki’s Cashflow Quadrant outlines four categories:

-

Employee: Exchanging time for money.

-

Self-Employed: Providing a service but doing most of the work.

-

Business Owner: Using systems and teams to generate revenue.

-

Investor: Making money work for you.

Most of my clients are transitioning from self-employed to business owners, aiming to build personal wealth. Effective cash flow management involves balancing various profit centers, such as paying yourself, tackling debt, saving, and investing.

The Art of Cashflow Management

When you work with us, we create a detailed cash flow forecast for your business and personal finances, providing a weekly snapshot for the next year. Delaying support for your finances can prolong the achievement of your lifestyle and legacy goals.

Read also: 3 Reasons You Don’t Have Cash on Hand Even Though You Have a Multi-6 Figure Business

Start with the End in Mind

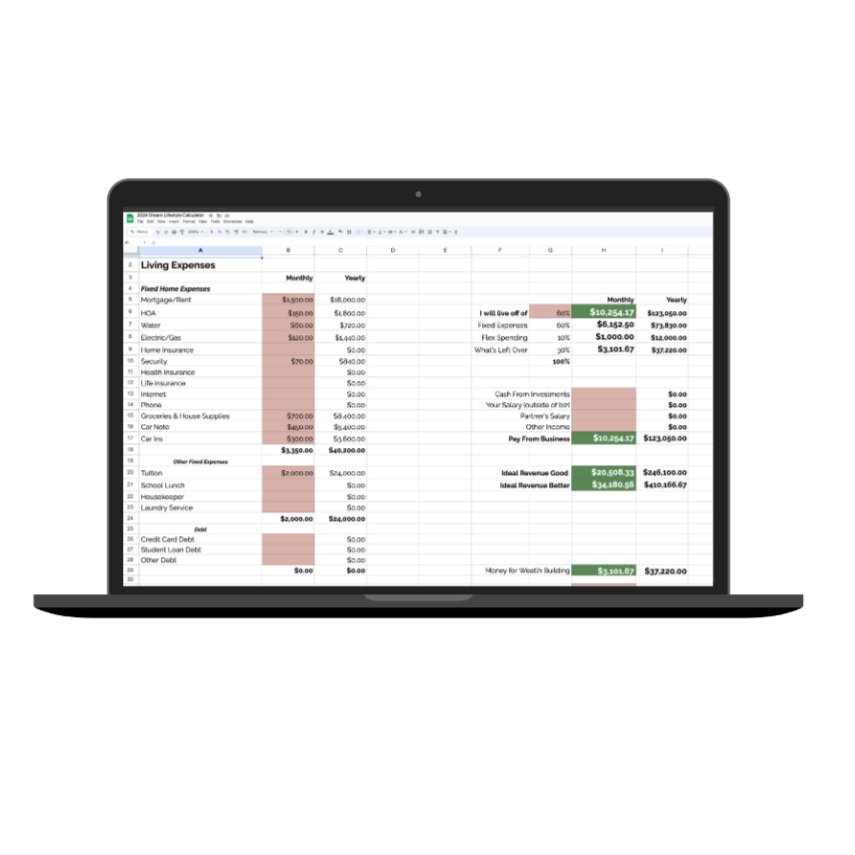

If you’re ready to take control of your personal finances to avoid living paycheck to paycheck, the Dream Lifestyle Calculator can help. It shows what you need to pay yourself to thrive, save, invest, and achieve your legacy goals.

Quantify Your Dream Life

Uncover what you must pay yourself in your business to accomplish your immediate lifestyle and legacy goals, sign up to get my free The Dream Life Calculator.

Join the Harmonious Wealth Community

I’m on a mission to help 100 women reach at least $1 million in net worth to create generational wealth and break generational curses through their business. If this resonates with you, join our community and tune in to more episodes of Harmonious Wealth.

Top Episodes to Check Out

Revitalizing Your Daily Routine: Easy Ways to Infuse Energy and Positivity

Nurturing Self-Care: Prioritizing Your Well-being in a Busy World

Embracing Simplicity: The Art of Minimalistic Living

Weekly wisdom for faith-filled finances.

Get bite-sized tips on increasing profit, leveraging tax strategy, and stewarding your cash flow—rooted in biblical truth. Build wealth, heal your money story, and lead your business from a place of overflow.

The Overflow Report

THE EMAIL LIST

WEBSITE DESIGN CREDIT

Terms and Conditions

Privacy Policy

Join my email series

Hompage

About

portal

Podcast

Work with us

Browse Around

LFG

Iyanna Vaughn, founder of Lovely Financials Group, believes that financial management significantly impacts one's life. For over 8 years, she has helped business owners increase their profit & create healthy cash flow.

Paragraph

Paragraph