LISTEN ON APPLE PODCASTS

LISTEN ON SPOTIFY

Generating multi-6 and multi-7 figures in revenue means little if it doesn’t support the lifestyle and legacy you desire for your family.

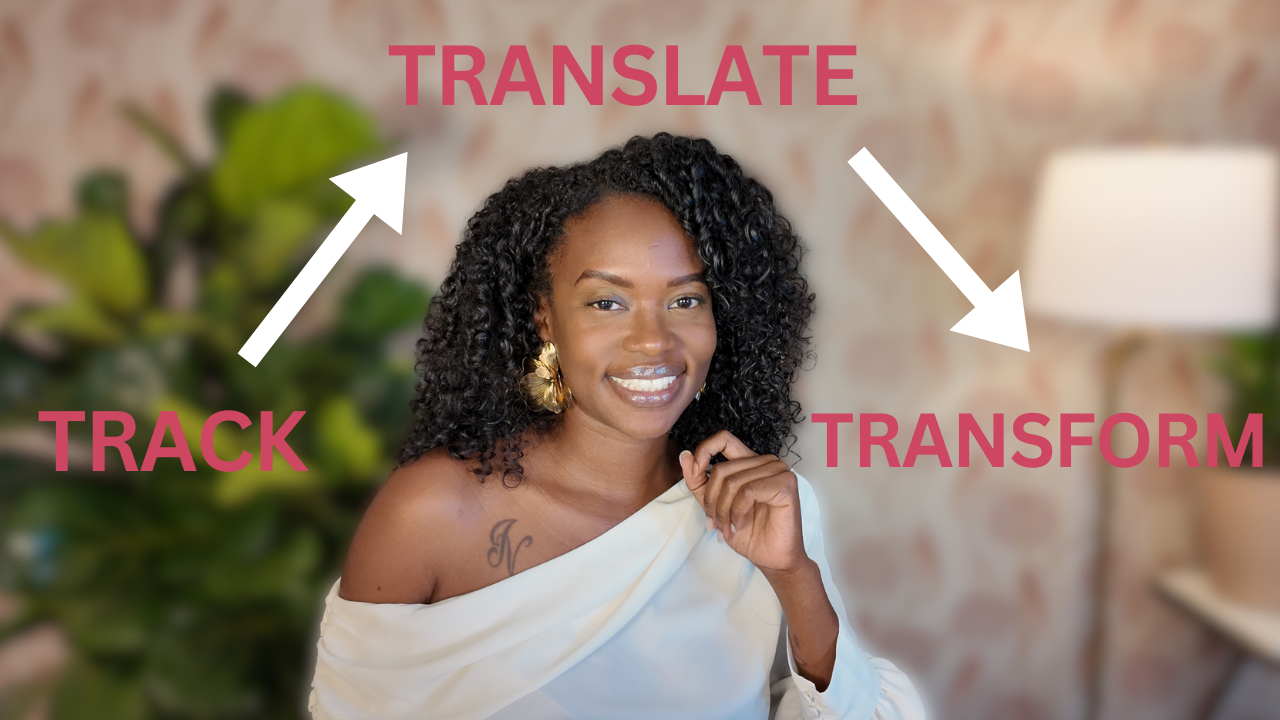

On Harmonious Wealth, host Iyanna Vaughn, fractional CFO and owner of the Lovely Financials Group, helps online business owners shift focus from revenue milestones to achieving lifestyle and legacy goals, ensuring your business success translates into personal wealth.

This fosters harmonious wealth between your business, lifestyle, and legacy.

Harmonious Wealth

with Iyanna Vaughn

THE PODCAST

THE PODCAST

watch on youtube

Top Episodes to Check Out

Paragraph

Paragraph