The first 5 steps to best manage your money as an entrepreneur

May 1, 2017

So you’ve started your business or on the beginning steps of starting your blog. Now what?! You ask yourself. You look to your left and right. All the other ladypreneurs in their chapter 5-20 are killing it in your industry. You get succumbed by imposter syndrome and analysis paralysis and remain stagnant. Simply because you don’t have the slightest idea on what to do first.

You go into groups and email people you idol: How you should monetize your blog? What you should be investing in first? I want to give you some super easy tips on how you can better handle the money in your business. Ease up those tensions a bit.

I’m aware of the anxiety money has for so many. But when you break it down into smaller chunks you will save so much time and cash in the long run. When you take the reigns on money in your business, you’ll avoid having to hire a bookkeeper (like myself). Avoid paying hard earned cash to clean up the mess or lack any bookkeeping to prepare for tax season.

If you follow these 5 key steps to follow when opening up your business or monetizing your blog, you’ll be able

Open a separate checking and savings account

You’ll thank me later when you’re not nose deep in commingling your funds. The biggest misconception is that you feel like you need your LLC before you get a separate account.

Wrong.

Go to a credit union or research a list of other free banks and open that account! This way, from the very beginning, you can see what exactly is coming in and go out in your business.

The savings account will house the tax estimates. Of course, your tax liability depends on how your family situation, state, and other factors. But that’s not a reason to avoid saving some money every month to taxes. The easiest way to be prepared is to transfer over 30% of your profits (when they start coming) every month.

No more whimpering in the Facebook groups about forking over taxes. Yes, the chunk of change you were intending on spending elsewhere in your business!

READ ALSO: How to stop commingling your personal and business funds now!

Track your money on an accounting platform.

You may be wondering, why in the world will I be going on an accounting platform once I start my business?! Well, the very first dollar you spend in your business should be tracked!

You can do this for free on Wave or start putting something like Freshbooks in your budget to get you started.

Imagine looking at your current P&L and backtracking to when you first started your business. You realize that you made more in this quarter than the entire first year of your business! Well, that’s exactly what I discovered. I was able to uncover this win because of how well I tracked my finances from the very beginning of my business.

There was nothing more satisfying! I built momentum and saw the benefits a year later. I saw what my patience and persistence warranted.

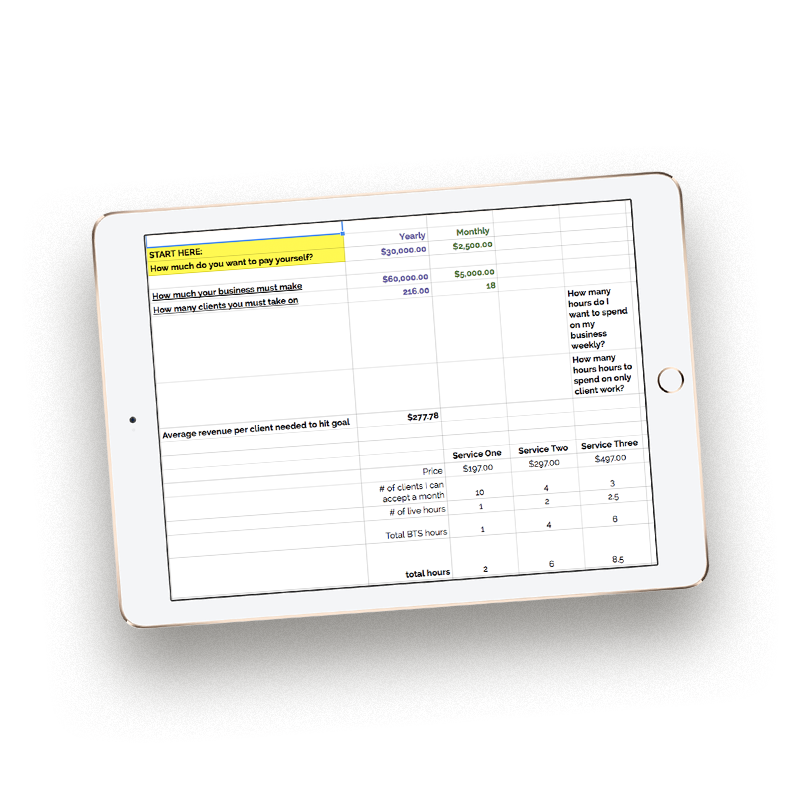

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!

Carve an allowance for your business from your personal budget

The money to invest in your business has to go from somewhere. Before you pull out your credit card and acquire mountains of debt, be your own angel investor! Go over the numbers the personal budget with your spouse, partner, or someone close to you. Talk about what you will need to put into the business in the next year to start growing it where it needs to be.

Start lean and calculate how much it will cost to run your business.

Sidenote: If you know that you want to invest in a coaching program or course, open a separate account. You can budget for it months before you’re ready to bring on your coach!

Before my business was making a consistent income, I knew that I had to cut the budget on getting my nails and eyelashes done (I can’t go without the brows, tho!). I was able to consistently put in about (make part of newsletter on Tuesday)

So let’s say 6 months down the line, you’re pulling a profit. You’re pulling in consistent income and finally able pay yourself back!

Keep track of those expenses paid by personal funds

Like angel investing, you may have software subscriptions, client meals, conferences, and more. This can all be coming from your personal account until you’re able to take the training wheels off and fund your business. This is when you need to start using an expense report.

This is similar to how you may have used it in corporate on outings while keeping all receipts. Then when your business is ready to start paying you back, create a bill in your accounting platform and start to pay yourself back.

You can do this every month or quarter. Just be sure to have a paper trail. Wave allows you to store receipts. But my favorite receipt management tool for clients has been HubDoc.

READ ALSO: 10 tax deductions you should never miss as an entrepreneur

Create and continuously update your profit plan

It’s one thing to create income in your business, but you also must find a way to create a way to keep money in your business to be profitable. This profit plan should include who you’re selling to, what you’ll be selling and how you’re going to deliver it. How long does it take you to complete it every month and how many customers you’d like to bring on!

Create a strategic plan to price your services so you can be able to eventually pay yourself, grow your team, etc.

With a profit plan, you’ll be able to know if you can actually afford that course or program. Last year as a newbie entrepreneur, I suffered from FOMO. I ended not crystallizing my services because being multi-passionate made me not have one concrete idea. I had to found a way to land new clients every month and being profitable.

Want to learn how to price your services for profit?!

Download my FREE pricing calculator below now!

So I hope this post has helped you! Understanding how to managing your finances in your business is so essential. This is best done Before you dive head first in buying a beautiful logo or buying #allthecourses. Have this in place so you’re not trekking blindly in this entrepreneurial space.

Let me know what questions you have about keeping up with the finances in your business! What are you struggling with? I’d love to know in the comments!

Top Episodes to Check Out

Revitalizing Your Daily Routine: Easy Ways to Infuse Energy and Positivity

Nurturing Self-Care: Prioritizing Your Well-being in a Busy World

Embracing Simplicity: The Art of Minimalistic Living

Weekly wisdom for faith-filled finances.

Get bite-sized tips on increasing profit, leveraging tax strategy, and stewarding your cash flow—rooted in biblical truth. Build wealth, heal your money story, and lead your business from a place of overflow.

The Overflow Report

THE EMAIL LIST

WEBSITE DESIGN CREDIT

Terms and Conditions

Privacy Policy

Join my email series

Hompage

About

portal

Podcast

Work with us

Browse Around

LFG

Iyanna Vaughn, founder of Lovely Financials Group, believes that financial management significantly impacts one's life. For over 8 years, she has helped business owners increase their profit & create healthy cash flow.

Paragraph

Paragraph